Coldwell Banker

Coldwell Banker

2023 Real Estate Market Report

North Lake Tahoe -Truckee

Residential Properties – Single Family Homes and Condominiums

Activity for the calendar year 2023

Residential Sales Summary 2023

Total Residential Sales:

Living in Tahoe and selling real estate is always full of surprises and challenges. 2023 was no exception. The headwinds during 2023 were numerous, but were headlined by a massive winter (that made it difficult to put homes on the market at all), inflation, rising interest rates, and a cooling national real estate market.

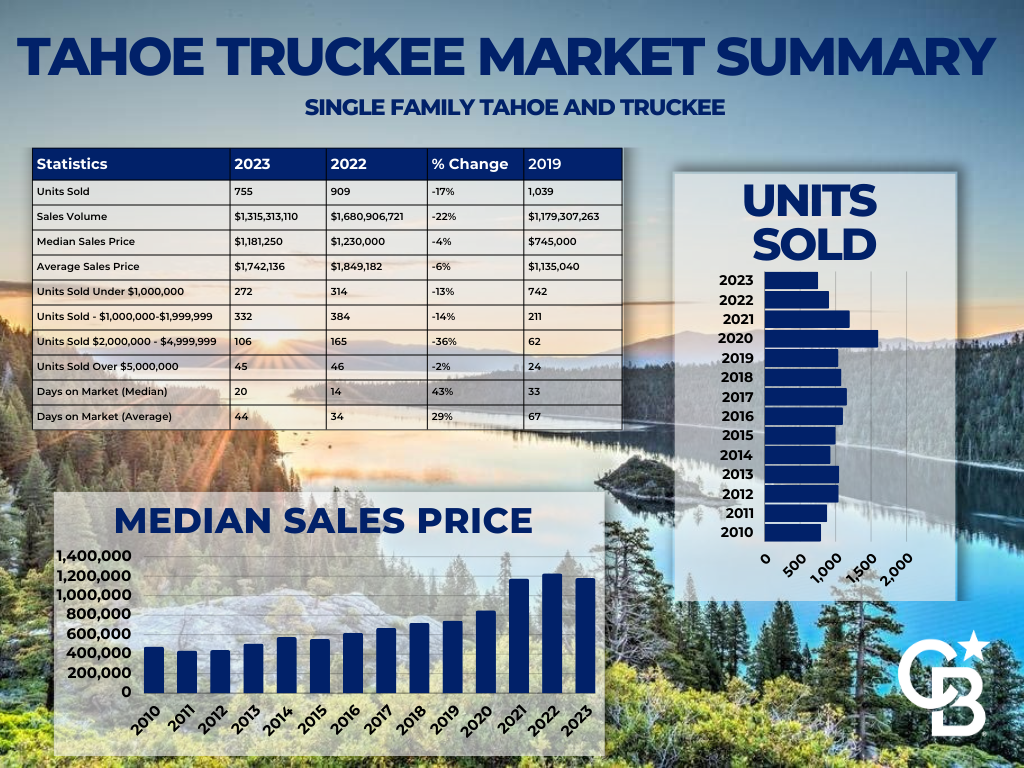

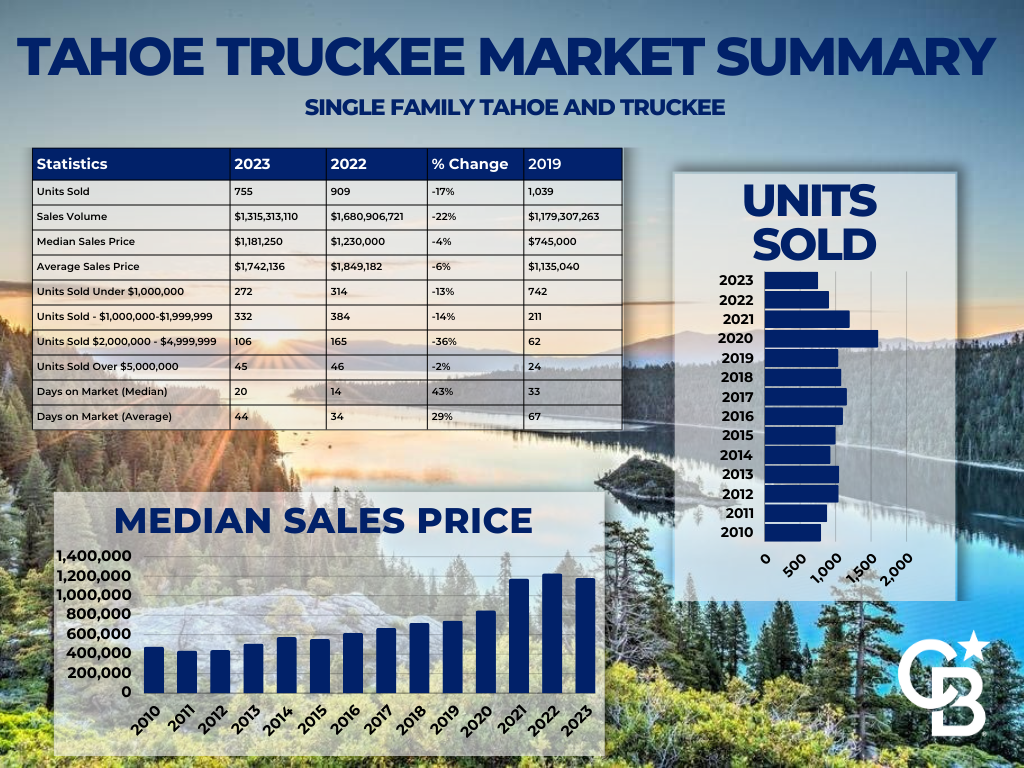

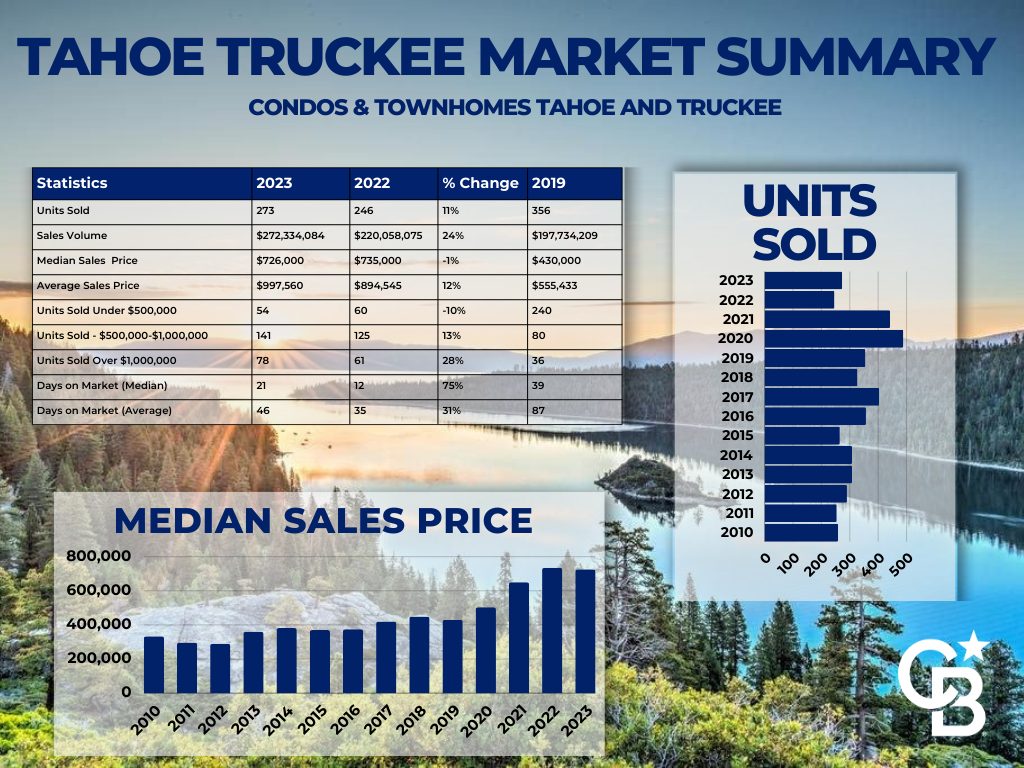

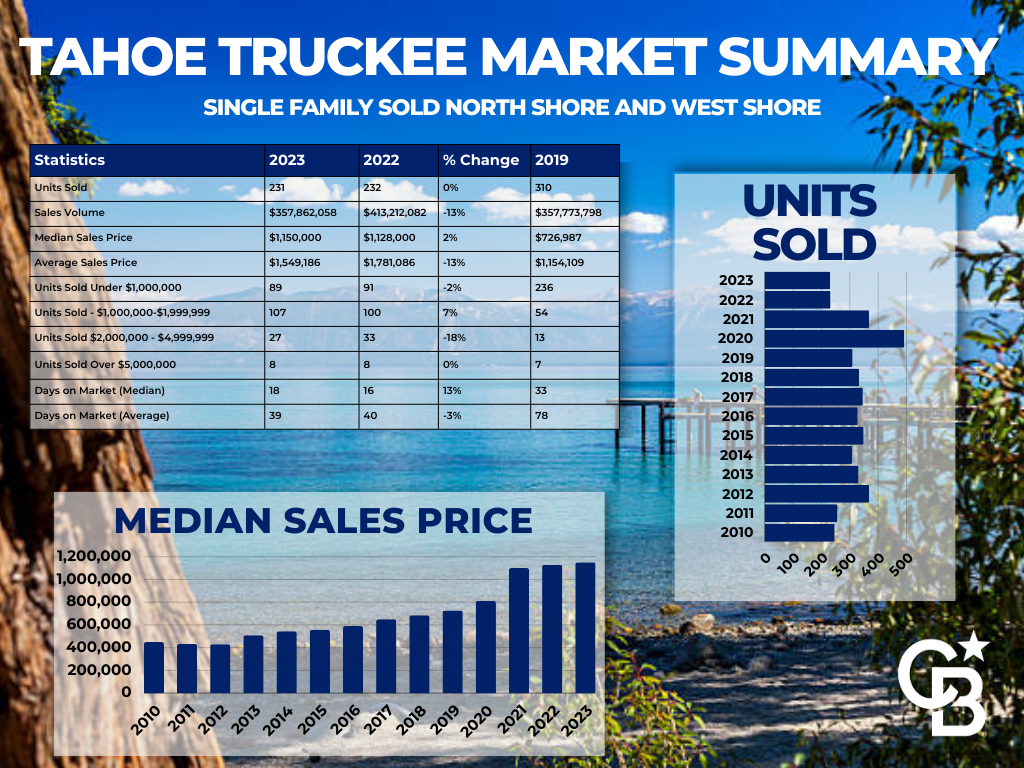

For the year, the total number of residential transactions decreased by 11% compared to 2022 and ended up 30% below the 5 year average and 28% below the 10 year average. It was the lowest number of residential transactions in the last 10 years.

Median and Average Sales Prices: The smaller number of transactions was accompanied by some softness in pricing. The median price of a residential sale dropped by 3.6% (from $$1.1 million in 2022 to $1.06 million in 2023) while the average sales price dropped by 6.2% (from $1.646 million to $1.544 million).

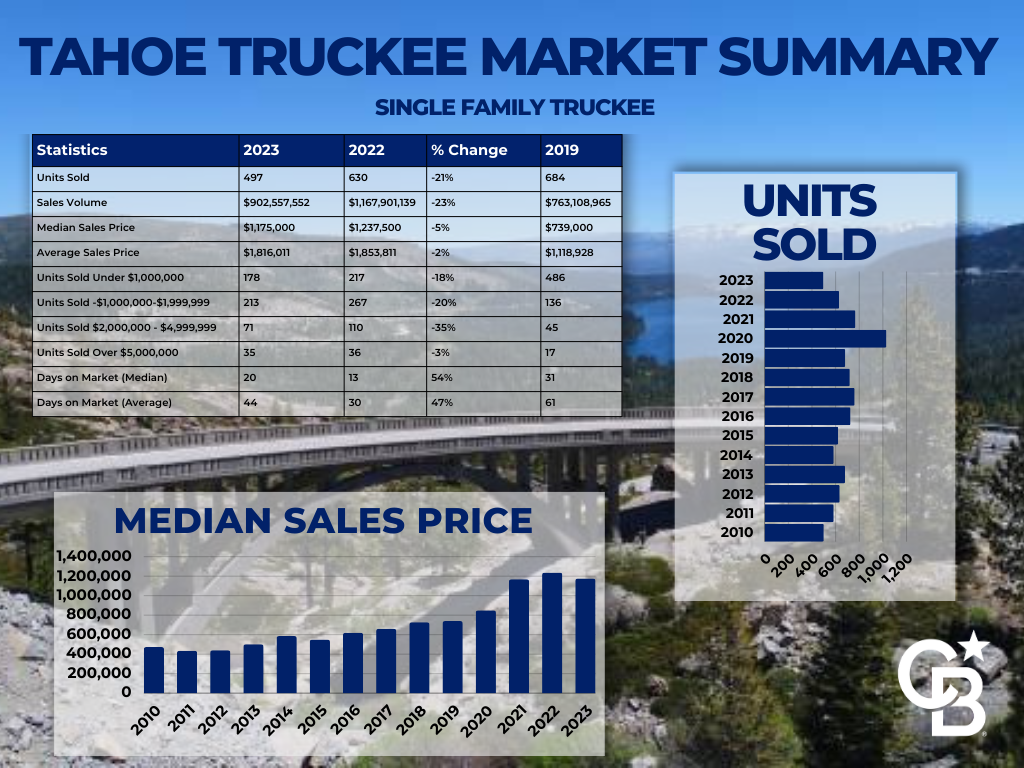

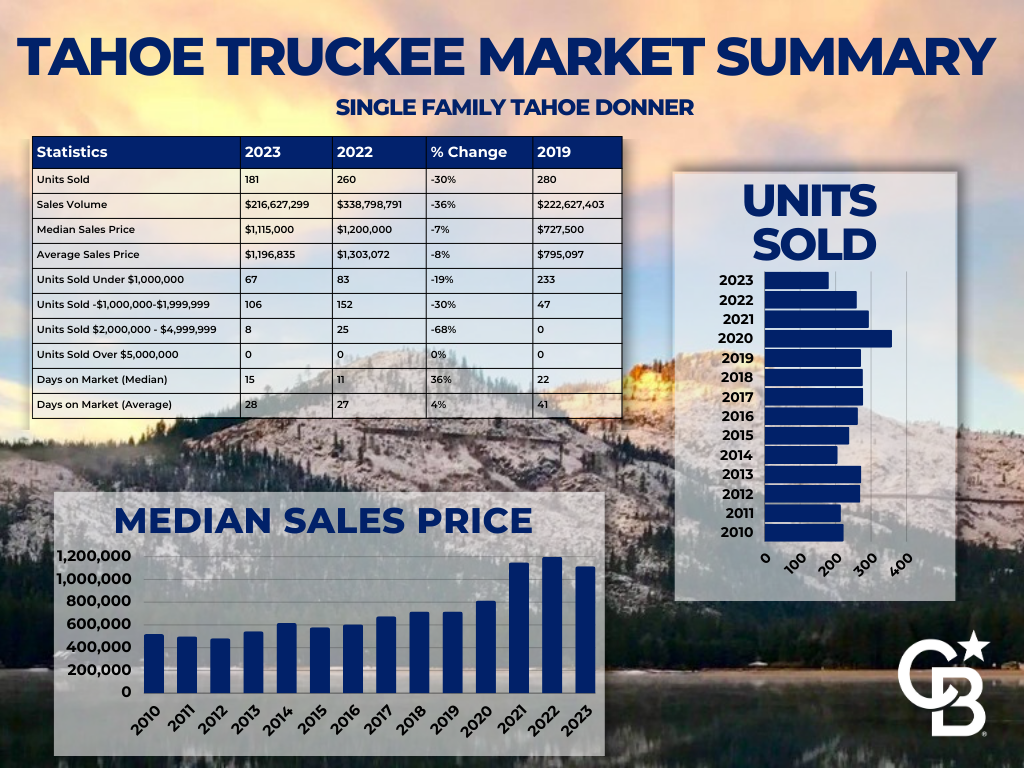

For single family homes the median was down 4% (from $1.23m to $1.181m) and the average price was down 6% (from $1.849m to $1.742m).

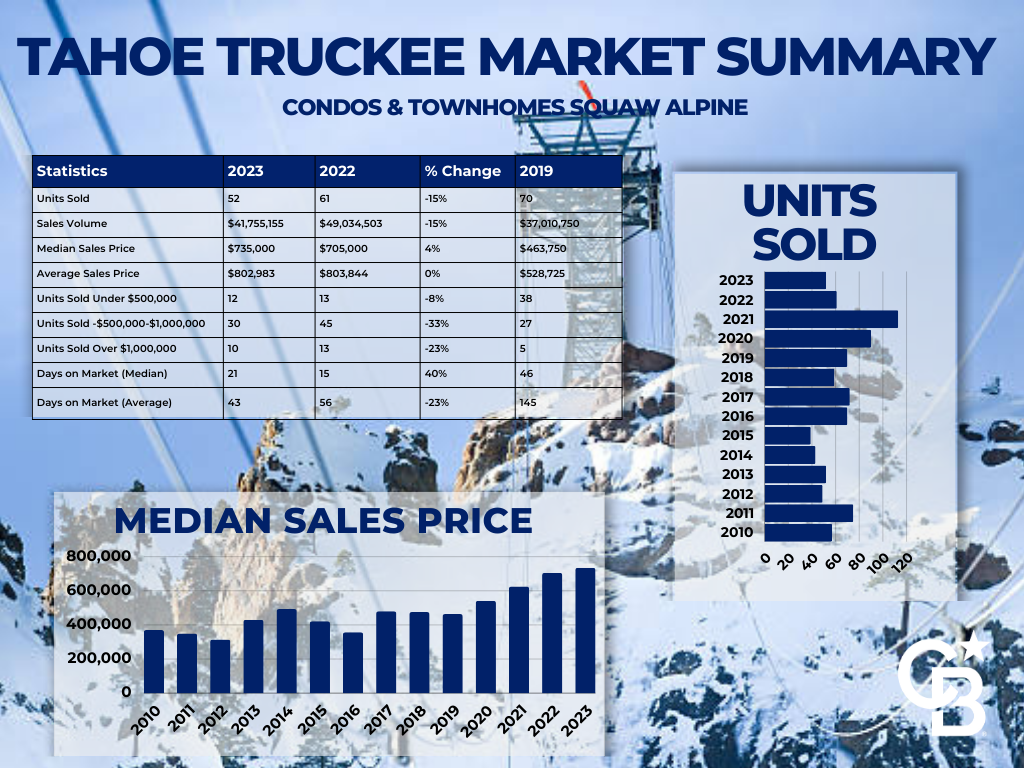

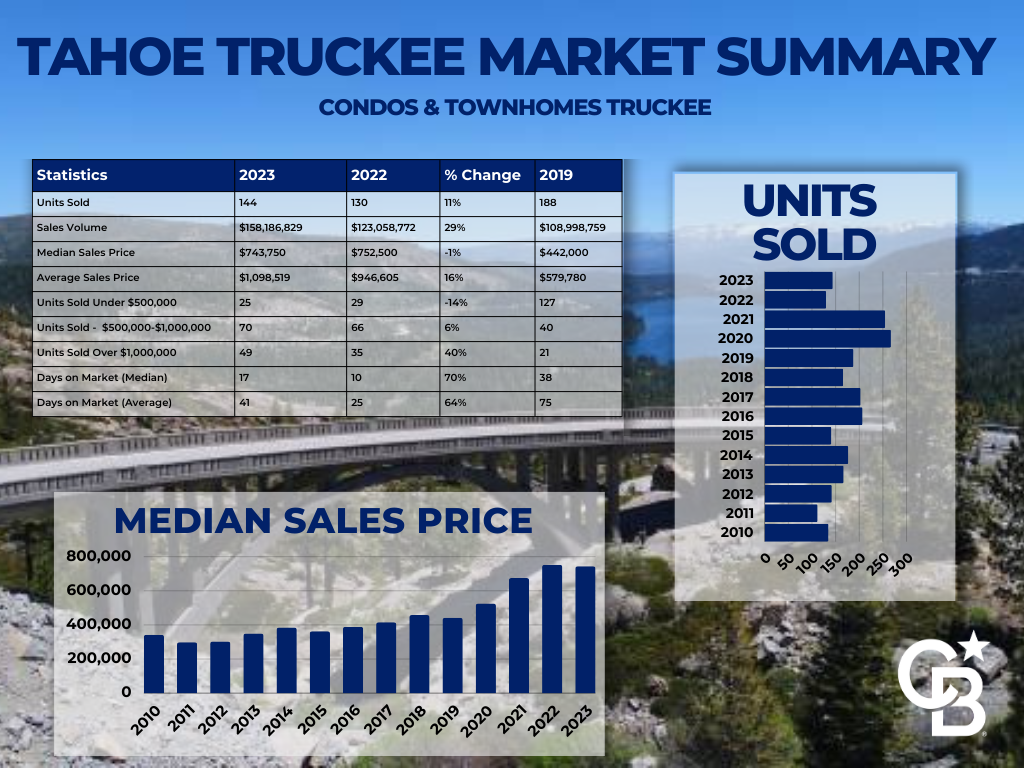

For condos the median price was down 1% (from $735k to $726k) but the average is actually up 12% (from $895k to $998k).

That said, prices are still at a very healthy premium from where they stood in 2019 (before COVID). For single family homes the median sales price is up 59% compared to 2019 (from $745k to $1.181m) and the average sales price is up 53% (from $1.135m to $1.742m).

For condos the median sales price is up 69% compared to 2019 (from $430k to $726k0 and the average sales price is up 80% (from $555k to $998k).

Active Residential Inventory:

Active Listings: We are in the heart of winter, when inventory hits annual lows. There are 230 residences currently on the market. Last year, at this time, there were about 180 residences actively for sale, but in 2019 the number was closer to 400. Looking at long term numbers, inventory is still at the lowest levels we have seen historically prior to COVID (Around 60% of the average for the 5 years prior to COVID and 40% of the 10 year average) for this time of year.

Current Pending Sales: The number of pending sales is at 55 (down from 62 last year at this time).

Current inventory represents a little over 4.2 months of supply relative to December activity. Historically any number below 5 months of supply is considered a seller’s market. But, this is the most balanced market we have seen in years.

Sales Under $500,000: In 2023, there were 60 residential sales under $500k, representing 6% of total sales. In 2022, 6% of sales were in this range as well.

Mid-Range Market Sales $500,000 to $999,999: For the year, 407 residences sold between $500,000 and $999,999, representing 40% of total sales. In 2022, 37% of sales were in this price range.

High End Home Sales $1,000,000 to $1,999,999: 381 residences sold between $1m – $2m, representing 37% of total sales. In 2022, 37% of total sales were in this range as well.

Luxury Home Sales Over $2 Million: 180 residences sold over $2 million in 2023, representing 18% of total sales. This includes 46 sales over $5 million, of which 7 were over $10 million. In 2022, 226 residences sold over $2 million, representing 20% of sales. This includes 46 sales over $5 million, of which 15 were over $10 million, 2 over $20 million, and 1 over $40 million.

What’s Going On Looking Forward?

The extremely strong “covid boom” real estate market is in the rearview mirror and we have turned to well below average activity across the region for the last 18 months. However, the inventory of homes for sale has not built up and prices have only softened slightly.

Is the market activity going to change dramatically in 2024 compared to 2023? Probably not. If it does, it will likely come from something not currently on our radar.

A strong stock market and declining interest rates usually helps strengthen demand in our local market, which gives us reason to hope for increased activity in the coming year. The election, of course, will be an interesting variable to sprinkle in.

Low inventory will continue to be a big force on the supply side of the market. Inventory is still below half of what we typically saw at this time of year in the pre-COVID benchmark years.

Multiple offers on properties has become uncommon and bidding wars (5+ offers) have almost gone away. But price reductions seem to only be occurring on 5% of listings each week (not a strong trend).

We expect below “normal” (by pre COVID standards) activity, measured by number of transactions, to continue in Q1 2024, but are hopeful to see transactions climb toward normal averages as we get deeper into the year.

Sellers, keep in mind, this is still a much better time to be a seller than it was in 2019 (which seemed like a very healthy market at the time!). You can expect a shorter time on market, but much higher sales prices!

Buyers, keep in mind, this is the most balanced market we have seen in the last 3 years. You now have the following things working in your favor:

- The ability to negotiate price is back!

- The ability to inspect a property and have normal contingencies is back!

- The ability to negotiate repairs is back!

- Yes, interest rates are climbing, but if they continue to climb you will be glad you locked in now. If/when they do reverse course, you can refinance to take advantage!

Contact Me Today to Find Out More about the Opportunities Available in the North Lake Tahoe-Truckee Market.

Note: Data on this page is based on information from the Tahoe Sierra Board of Realtors, MLS. Due to MLS reporting methods and allowable reporting policy, this data is only informational and may not be completely accurate. Therefore, Coldwell Banker Realty does not guarantee the data’s accuracy. Data maintained by the MLS may not reflect all real estate activity in the market. CA-BRE License # 01908304

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link