Coldwell Banker

2023 Real Estate Market Report

North Lake Tahoe -Truckee

Residential Properties – Single Family Homes and Condominiums

Activity Q1 January- March 2023

Residential Sales Summary 2023

Total Residential Sales:

Intense winter weather and ongoing economic headwinds have continued to limit the number of real estate transactions in the Tahoe region. In March, 52 Residences sold, which is the lowest number of March sales in the last 10 years and 60% of the 5 year average for the month and 58% of the 10 year average.

March marked the sixth consecutive month that we hit a 10 year low for the number of residential transactions for the month. At this point, the lack of activity is clearly a trend and not an anomaly.

For Q1, 152 residential transactions have closed. This, again, marks the lowest Q1 total in the last 10 years and 62% of both the 5 and 10 year average. It should be said, winter is always our slowest time of year, so don’t panic about these numbers. A couple busy spring and summer months can easily put things closer to normal. The question is, how busy will spring and summer be this year?

Median and Average Sales Prices:

With the small number of transactions, median and average sales prices tend to bounce around rapidly as they get skewed by what would normally be minor anomalies.

The median sales price for March came in at $1,297,500 and the average was at $1,975,429. Year to date, the median sits at $1,015,000 and the average at $1,452,186.

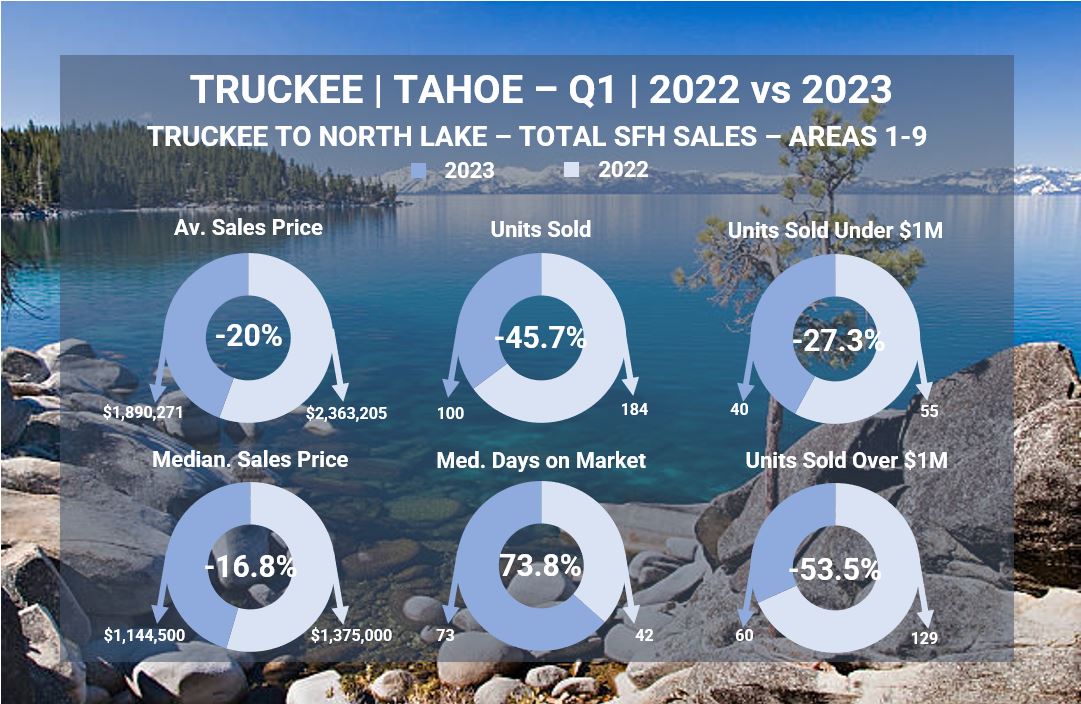

For Q1, the median single family sales price came in at $1,144,500. That represents a decrease of 16.8% compared to Q1 2022, but is still 60.1% higher than Q1 2019 (pre-pandemic). The average single family sales price for Q1 was $1,890,271, which is down 20% compared to Q1, but still 31.6% higher than 2019.

For condos, the Q1 median sales price was $767,500. That’s down 1% compared to Q1 2022, but up 75.6% compared to Q1 2019. The Q1 average came in at $1,132,958, which is up 28.1% compared to Q1 2022 and up 98.1% compared to Q1 2019.

Active Residential Inventory:

Active Listings:

We have finally started to see spring like weather the last couple weeks, which usually triggers an influx of residences coming on the market. This year, that influx will be delayed by the incredible snow pack that still sits on the ground. There are 165 residences currently on the market (up from 155 a month ago). Last year, at this time, there were about 110 residences actively for sale, but in 2019 the number was closer to 350. Looking at long term numbers, inventory is still at the lowest levels we have seen historically prior to COVID (Around 60% of the average for the 5 years prior to COVID and 40% of the 10 year average) for this time of year.

For 23 consecutive months the number of new listings for that month has been below the 5 and 10 year averages. In each of those 23 months the number of new listings has been among the 3 lowest totals for that month in the last 10 years.

Current Pending Sales: The number of pending sales is at 55 (holding steady around 60 for the last 4 months). About 52 residences went into contract in March (up from 40 in February).

Current inventory represents about 3.2 months of supply relative to March activity. Historically any number below 5 months of supply is considered a seller’s market. But, this is a much more balanced market, even tipping toward buyer’s market, than that statistic might lead you to believe.

Sales Under $500,000: Through Q1 there were 14 sales under $500k, representing 9% of all residential sales. For the same period in 2022, 7% of sales were under $500k.

Mid-Range Market Sales $500,000 to $999,999: 56 residences have sold between $500,000 and $999,999, representing 37% of total sales. In 2022, 35% of sales were in this price range.

High End Home Sales $1,000,000 to $1,999,999: 53 residences sold between $1m – $2m, representing 35% of total sales. In 2022, 35% of residential sales were in this range.

Luxury Home Sales Over $2 Million: 29 residences sold over $2 million, representing 19% of sales. This includes 10 sales over $5 million. In 2022, 23% of residential sales were over $2 million including 17 sales over $5 million.

What’s Going On Looking Forward?

Per the Sierra Snow Lab on Donner Summit, this is the 2nd snowiest winter since they started keeping records in 1946. The intense winter has definitely impacted what was already a slowing real estate market. In the past, big winters have resulted in increased supply in the spring and summer (seller’s saying, “I don’t want to deal with that again”) while also increasing demand (buyer’s saying, “what an incredible ski season, let’s buy a house!”).

Which force will be stronger in spring and summer of 2023?

Low inventory will continue to be the story at least until the snow melts (May? June?? July???). It will be interesting to see if the intense winter and economic headwinds will be enough to push supply closer to “pre-covid” norms after we thaw out.

There is a little bit of momentum building on the demand side . . . a few more showings, more people visiting open houses, a significant number of multiple offer situations in the last month, a few properties selling that had been on the market for an extended time. We’ll have to wait and see if that momentum is sustainable in the current economic environment or just a blip on the radar.

Sellers, keep in mind, this is still a much better time to be a seller than it was in 2019 (which seemed like a very healthy market at the time!). You can expect a similar amount of time on market, but much higher sales prices!

Buyers, keep in mind, this is the most balanced market we have seen in the last 3 years. You now have the following things working in your favor:

- The ability to negotiate price is back!

- The ability to inspect a property and have normal contingencies is back!

- The ability to negotiate repairs is back!

- Yes, interest rates are climbing, but if they continue to climb you will be glad you locked in now. If/when they do reverse course, you can refinance to take advantage!

Contact Me Today to Find Out More about the Opportunities Available in the North Lake Tahoe-Truckee Market.

Note: Data on this page is based on information from the Tahoe Sierra Board of Realtors, MLS. Due to MLS reporting methods and allowable reporting policy, this data is only informational and may not be completely accurate. Therefore, Coldwell Banker Realty does not guarantee the data’s accuracy. Data maintained by the MLS may not reflect all real estate activity in the market. CA-BRE License # 01908304

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link